Key Summary:

- The Iran-Israel conflict has evolved into a direct and highly destructive military confrontation, with both sides targeting each other’s critical energy infrastructure.

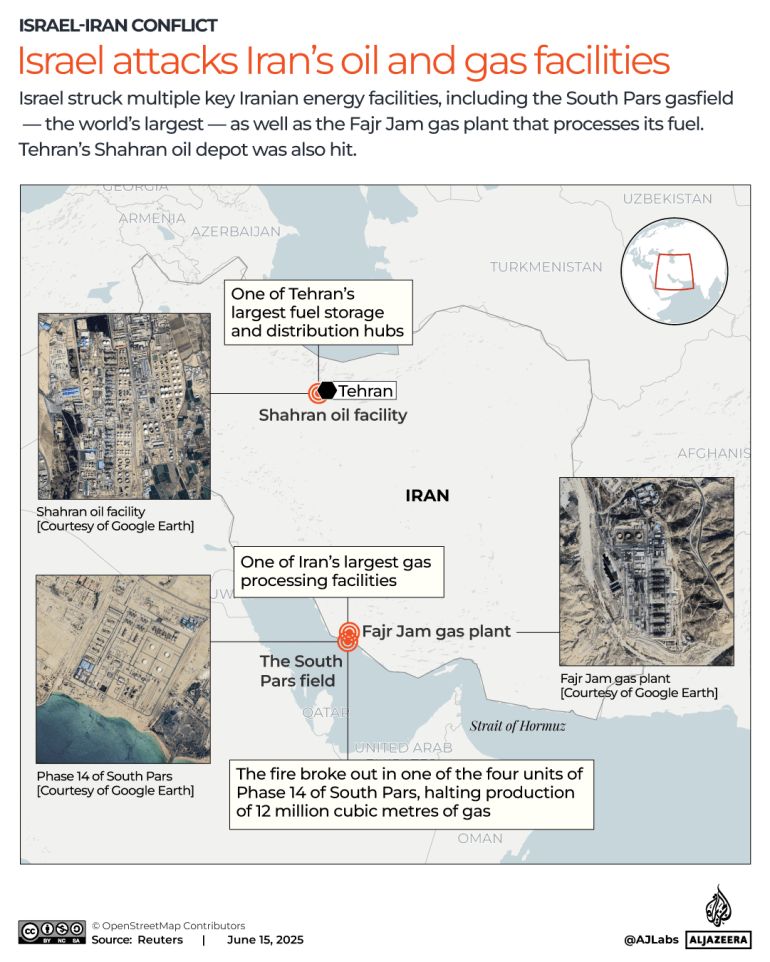

- Key Iranian energy sites, including South Pars gas field, Shahr Rey refinery and Fajr Jam gas plant-have sustained significance damage, straining domestic supply and threatening global markets.

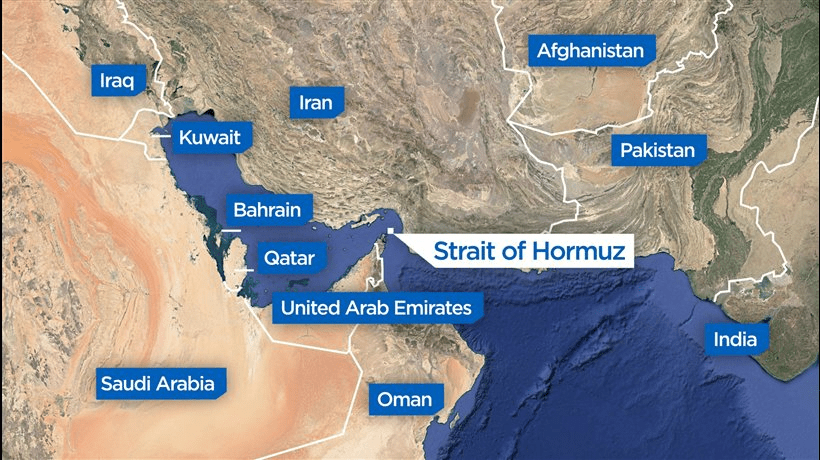

- The conflict poses a growing risk to global energy supply chains, particularly through the Strait of Hormuz, which channels nearly 20% of global oil exports.

- Energy prices have surged, with Brent crude spiking over 13% after the first attack.

- Geopolitical tensions are rising beyond the Middle East, with China, Russia, Gulf states and the US recalibrating trheir strategic response.

In June 2025, the world witnessed an escalation in the Middle Eastern tensions as Israel launched a surprise strike on Iranian nuclear and energy infrastructure. What began as said to be military pre-emption, quickly turned into a regional confrontation involving retaliatory missile strikes, civilian casualties and targeted hits on critical oil and gas sites. However, beyond the battlefield, this conflict is sending ripples through the global energy supply chain.

Israel’s strikes on Iran’s South Pars gas field, the Tehran oil refinery and major fuel depots, combined with Iran’s retaliation on Israeli energy assets, have sparked fear of sustained supply disruptions. Energy prices are already rising, insurance premiums on shipping are climbing, and if escalation continues, especially around the Strait of Hormuz, the world could face an energy shock of historic proportions.

The Strategic Significance of Escalation

For decades, Iran and Israel have been in shadow wars: covert sabotage, cyberattacks, and proxy battles in Lebanon, Syria and Yemen. This time, they have a direct confrontation and are engaging in open warfare. In a matter of days, Israel has conducted coordinated attacks on over 100 Iranian targets. These include military sites, nuclear enrichment facilities, and energy hubs vital to both Iran’s domestic supply and its export economy. The assassination of senior Iranian commanders and nuclear scientists adds a new level of provocation.

In retaliation, Iran has launched a series of missile and drone strikes targeting Israel’s coastal cities, including Tel Aviv and Haifa. In Haifa, a missile strike disrupted operations at one of Israel’s largest refineries, hinting that Iran, too, is willing to escalate toward infrastructure with broad economic consequences. What makes this conflict more dangerous is its crossover into strategic economic domains, most notably, the energy sector.

Iran’s Energy Infrastructure Under Fire

- Shahr Rey Oil Refinery in southern Tehran & Shahran Fuel Depot in northern Tehran: two hubs that together supply a large share of fuel to the capital’s population. The refinery in particular processes 225,000 barrels of crude per day and is vital to both fuel logistics and electricity generation. While Iranian state media has attempted to downplay the extent of damage, images from the sites suggest a serious disruption to operations. The result is a growing strain on power availability across urban and industrial areas.

- South Pars Gas Field: the world’s largest natural gas field. It is situated in southern Bushehr province and is shared with Qatar. South Pars produces two-thirds of Iran’s domestic gas and holds nearly 20 per cent of the world’s known gas reserves. Israeli drone attacks triggered fire at Phase 14 of the project and disabled offshore platforms producing over 12 million cubic meters per day.

- Fajr Jam Gas Processing Plant: It is located in Bushehr province and is a key conduit for transforming South Pars gas into usable fuel. The damage has caused it to partially shut down, leaving southern Iran on edge with fears of blackouts and economic slowdowns.

Israel Under Fire: Iran’s Counterstrike

Iran’s response has been both aggressive and calculated. Among the most notable acts of retaliation was a missile strike on the Haifa refinery complex. While the extent of damage remains under assessment, pipeline systems were reportedly hit, causing a temporary halt in fuel processing. The consequences were immediate: Jordan and Egypt, which rely on gas flows from Israeli offshore fields like Leviathan and Tamar, reportedly disrupted. This introduces a new vulnerability for neighbouring states that import Israeli gas to stabilise their own power sectors.

The broader risk now is that Iranian retaliation could expand toward Israeli offshore platforms. These facilities are exposed and difficult to defend, particularly in a sustained conflict.

The Strait of Hormuz: The World’s Most Fragile Artery

No assessment of this conflict’s energy impact is complete without acknowledging the threat to the Strait of Hormuz. The narrow waterway between Iran and the Arabian Peninsula is the maritime passage for nearly 20 per cent of the world’s oil. In recent days, Iranian officials and IRGC (Islamic Revolutionary Guard Corps) commanders have revived threats to restrict or harass shipping through the strait.

Historically, Iran has avoided following through on such threats. However, with its energy assets under direct attack and its government under pressure to respond with strength, the possibility of a confrontation in these waters has become more real. Already, insurers are raising premiums for vessels operating in the region, and tanker traffic is showing signs of hesitation.

Market Reactions: A World on Edge

The initial market response was swift. On the day of Israel’s first strike, Brent crude surged over 13 per cent before retreating slightly to settle around $75-80 per barrel. West Texas Intermediate followed suit, and natural gas futures in Europe and Asia also posted moderate gains. Traders and analysts are closely watching every new strike and speech for signals of further escalation.

If Iran’s major export terminals, such as Kharg Island, which handles nearly 90 per cent of Iranian crude exports, or domestic refineries like Abadan are targeted, the world could lose up to 2 million barrels per day from the global market. This would most acutely affect China, Iran’s top oil customer, and force a rebalancing of energy flows toward alternative suppliers like Saudi Arabia, Iraq and Russia.

Freight costs, especially for routes through the Red Sea and Indian Ocean, would increase sharply as ships reroute to avoid the Gulf. In such scenario, oil prices could break through the $100-120 per barrel threshold. That in turn would create ripple effects throughout energy-intensive industries, raise shipping and manufacturing costs and add upward pressure on global inflation.

In the 1980s, during the Iran-Iraq “tanker war”, over 400 ships were attacked, causing insurance rates to skyrocket and rerouting maritime flows for years. Even a single incident in Hormuz today, whether a deliberate strike or a miscalculated encounter, could trigger an outsized market reaction.

Strategic Implications: The Global Chessboard

- China: The conflict is reverberating beyond the Middle East. China, as Iran’s biggest oil buyer, faces a direct energy security threat. It is under pressure to recalibrate its energy sourcing strategy. It is expected to increase purchases from Gulf states (like Saudi Arabia and Iraq) and Russia, but remains vulnerable to further disruptions. Beijing may leverage its economic ties with Iran to pressure the leadership toward de-escalation, recognising that a full-scale regional war would endanger its broader Belt and Road ambitions and global energy strategy.

- Russia: Russia condemns Israel’s strikes, casting them as destabilising actions that could provoke wider conflict. Russia also sees economic opportunity. With Iranian crude potentially constrained by war, Moscow could position its discounted oil exports as a replacement for Asian buyers. It may also seek to use the crisis to deepen energy ties with China, offering more Siberian and Arctic crude in place of Middle Eastern supply, thus reinforcing Eurasian energy interdependence on Russian terms.

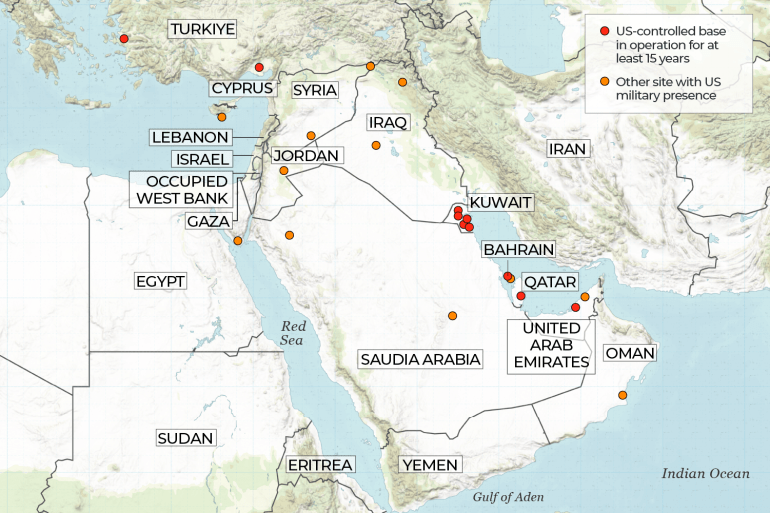

- Gulf States (particularly Saudi Arabia, the UAE and Qatar): These countries are geographically close to the flashpoint and host numerous U.S. military bases, making them fear of retaliatory strikes by Iran. Privately, Gulf leaders are believed to be urging Washington to restrain Israel’s attacks, particularly on energy facilities, fearing that escalation could provoke Iranian missiles aimed at their own infrastructure.

- The United States: The Trump administration has denied any direct role in the initial Israeli strike, its military presence in the region, political backing of Israel, and intelligence sharing ties it to the conflict. The administration now has to support a key regional ally, avoid fuel price increases, and manage expectations of Gulf partners. If the conflict expands, the US may have to reintroduce naval escort operations for commercial shipping in the Strait of Hormuz. Any misstep could risk dragging Washington into the conflict.

Scenarios Ahead: What Comes Next?

In the best-case scenario, a ceasefire could be brokered within days through diplomatic mediation by neutral actors, and the market reaction would likely stabilise. Oil prices, which surged following the initial strikes, could return to pre-conflict levels as traders price in the end of hostilities. The geopolitical tensions would remain, but would be confined; this outcome would restore investor confidence and reduce pressure on inflation-sensitive economies.

A more likely scenario involved continued aerial bombardment and military strikes without the conflict escalating to disrupting the Strait of Hormuz. In this case global oil benchmarks such as Brent would likely be elevated. Tanker routes may be adjusted to avoid risk zones, increasing transportation costs and insurance premium without causing a collapse in supply.

The worst-case scenario envisions a significant escalation, such as a full or partial closure of the Strait of Hormuz or a direct Israeli attack on Kharg Island, Iran’s most critical oil export terminal. In such a situation, the global economy would face an immediate and severe energy crisis. Oil prices would increase rapidly, triggering inflation spikes in developed economies and heightening the risk of a global recession. With energy prices spiralling and tanker traffic compromised, the geopolitical consequences would be dire. A direct confrontation between the United States and Iran would become more plausible, either due to threats to US forces in the Gulf or in response to allied appeals for security assistance. At that point, what began as a bilateral conflict could ignite a much broader regional crisis.

A Crisis in Motion

The 2025 Iran-Israel conflict has rapidly evolved into a test of global energy resilience. With attacks on strategic infrastructure, threats to maritime trade, and heightened geopolitical tension, the world is facing a complex crisis. Unlike localised conflicts in the past, this one threatens multiple nodes in the global supply chain.

At this point, the most pressing danger lies not in the damage already done but in the risk of further escalation, whether through miscalculation, retaliation, or entanglement by external powers. The next few weeks will be crucial in determining whether the world faces a manageable energy disruption or something more severe.

What is clear is that energy companies, governments, and financial institutions must begin preparing now. They need to account for longer shipping routes, rising insurance and logistic costs, potential supply reallocations and consumer price volatility. Strategic diplomacy, especially involving the US, China and Gulf nations will be critical to preventing a full-scale economic aftershock.

Disclaimer: Opinions expressed are solely my own and do not express the views or opinions of my employer

The article is based on developments as of 16 June 2025